Confirmed 87% Say Using Invoice Finance Enabled Their Growth

We have confirmed the link between the use of invoice finance and business growth during our programme of research into how to support fast-growing businesses.

We have confirmed the link between the use of invoice finance and business growth during our programme of research into how to support fast-growing businesses.

87% of existing invoice finance users (factoring and invoice discounting) told our survey that the use of invoice finance had enabled them to grow the turnover of their business.

This confirms that there is an enabling link between using invoice finance and creating a fast-growth business.

Direct Link To Creating Fast Growth

This finding is particularly significant as it goes beyond just finding a high concentration of invoice finance users amongst fast-growing businesses. It takes the correlation one step further and identifies the use of invoice finance as an enabler of fast growth.

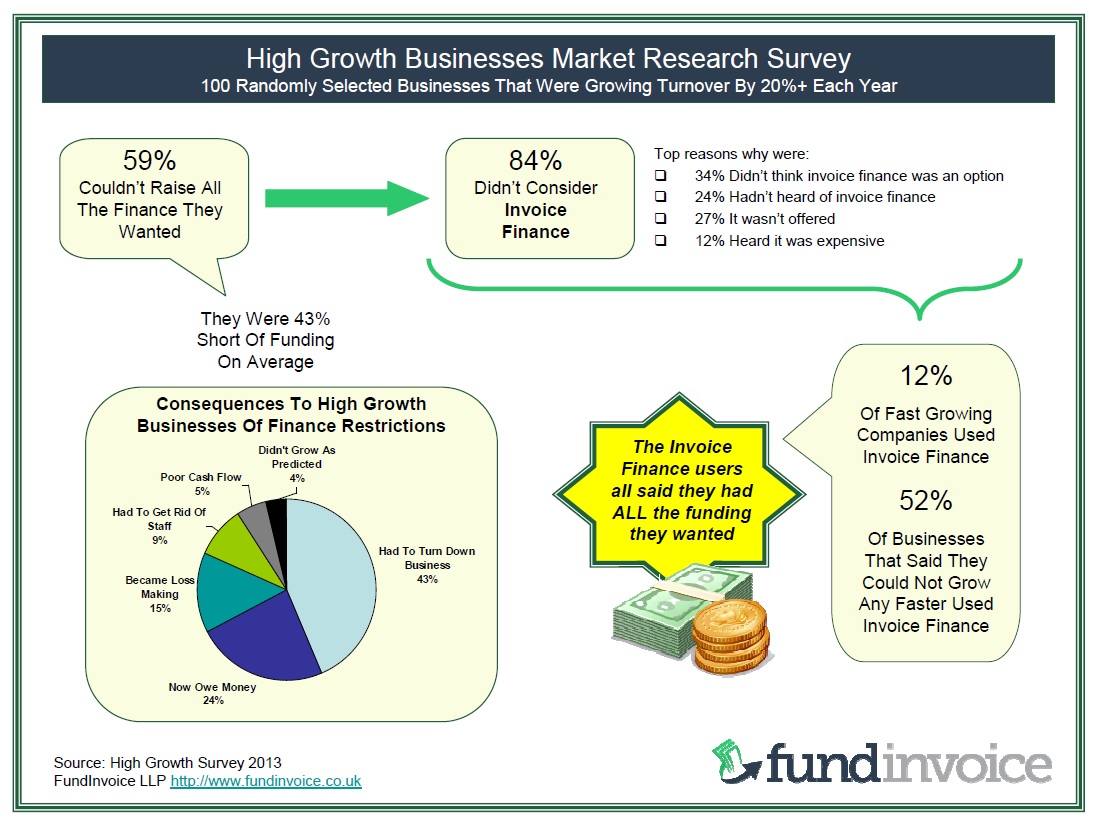

Our fast growth company research found that 12% of companies with turnover growth of 20%+ pa were using invoice finance, against our estimate of just 0.86% of UK businesses overall:

Furthermore, we found that 52% of maximum growth segment businesses, those that said they couldn't increase their growth any more, even with more funding, used invoice finance.

This new survey has gone further by asking existing invoice finance customers if using these services has enabled them to grow their business. The vast majority, 87% confirmed that it had. This has identified an enabling link, in the majority of cases, between using invoice finance and becoming a fast-growing business.

Source: Invoice Finance And Late Payment Survey - October 2015 (100 respondents - all existing users of invoice finance).