Debt Factoring

Debt Factoring Enhancing Liquidity for UK Companies

Robust cash flow stands as a critical challenge for businesses across the spectrum. Debt factoring offers a financial solution enabling companies to unlock the value of their accounts receivable and use that cash to boost their liquidity.

This article explores the fundamentals of debt factoring, its advantages, and its transformative potential for UK enterprises aiming to improve their financial health and drive growth.

Understanding Debt Factoring

Debt factoring is a financial transaction where a business sells its accounts receivable (outstanding unpaid sales invoices or similar applications for payment) to a factoring company that provides prepayments against these transactions.

The factoring of debts provides the business with an immediate cash advance, typically 85% to 95% of the receivable's value (it can be 100% minus fees sometimes). the factor then undertakes any credit control that may be required and when the customer settles the bill, the factoring firm pays the remaining amount to the business, after deducting a fee for the service provided.

This model is especially advantageous for businesses facing extended payment terms or needing to release more working capital. It stands out as a quicker and often more attainable funding option compared to conventional bank loans. The funding also grows as the company grows.

Debt Factoring In Business Definition

A debt factoring business provides a financial service where companies sell their outstanding invoices to a factor (or factoring company) at a discount to improve cash flow. This enables businesses to access immediate funds instead of waiting for customers to pay. In addition, the factor undertakes the credit control function for their client.

What Is Debt Factoring In Business?

The factoring company advances a percentage of the invoice value upfront and collects payment from the debtor, deducting a fee before remitting the balance. Debt factoring helps businesses manage working capital, reduce credit risk, and maintain healthy cash flow without relying on traditional loans or overdrafts. It is widely used by industries with extended payment terms, such as manufacturing, recruitment, and the transport trade.

Debt factoring in business is a financial solution that enables companies to improve cash flow by selling their unpaid invoices to a third party, known as a factor. This service is particularly beneficial for businesses that experience long payment cycles, as it allows them to access a significant portion of their invoice value upfront rather than waiting for customers to pay. The factoring company then takes responsibility for collecting payments, reducing the administrative burden on the business. Unlike traditional loans, debt factoring does not create additional debt on the company's balance sheet, making it an attractive option for maintaining financial stability while fueling growth.

Advantages of Debt Factoring

Immediate Cash Flow Improvement

The most significant benefit of debt factoring is the swift enhancement of cash flow. It enables businesses to convert sales on credit into immediate cash, avoiding the typical wait for payment term completion. This immediate liquidity is essential for covering day-to-day expenses, such as staff wages, supplies, and other expenses and outgoings.

Administrative Relief

Factoring firms assume responsibility for sales ledger management, providing credit control and collections. This shift can markedly reduce the administrative load on the businesses, freeing them to concentrate on their primary operations and sales growth.

No Need for Security Or Collateral

Debt factoring does not normally necessitate additional security or collateral (beyond the debts) in the traditional sense. The focus is on the debtor's financial stability and the quality of the service or product provided rather than the borrowing company's assets or financial position. This aspect makes debt factoring an accessible option for companies without significant assets to leverage or those that have credit issues.

Scalable Funding

Debt factoring provides a level of flexibility not typically available with other financing methods. The amount of funding a business can access through debt factoring is directly linked to its sales activity, offering a scalable solution that evolves in tandem with the business. The more sales that are made the more cash is released.

How Debt Factoring Works An Example

The debt factoring process includes a few key steps. This is a debt factoring example:

- Accounts Receivable Submission: The business forwards its outstanding accounts receivable to the factoring firm - this can be directly from the company's accounting software.

- Advance Payment: Upon evaluating the accounts, the factoring firm provides prepayments to the business, usually within a day.

- Collection: The factor undertakes the collection process, calling and corresponding directly with the customer for payment.

- Final Settlement: After full payment of the invoice, the factoring company disburses the residual balance to the business, after deducting their fees.

What Does It Cost?

For more information about pricing and costs see our detailed information on charges.

Selecting a Factoring Partner

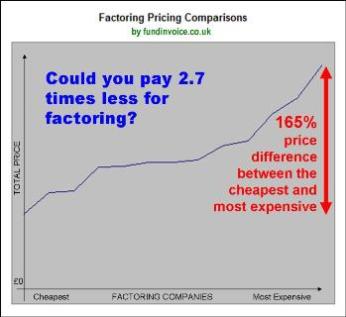

Choosing the most appropriate factoring company is vital for maximising the advantages of debt factoring. Businesses should consider the prepayment rate, any other funding restrictions, fees, contract conditions, and the quality of customer service. There can be significant swings in the terms and fees that different providers will offer.

It's equally important to partner with a firm that has insight into your sector and offers bespoke solutions that align with your specific requirements. For example, some funders offer specialised packages of services for recruiters.

How To Get Debt Factoring

Debt factoring is a compelling and efficient strategy for UK companies looking to bolster their cash flow and operational capabilities. By transforming accounts receivable into immediate capital, businesses can more effectively manage financial hurdles and capitalise on expansion opportunities.

Support Service

As with any significant financial decision, careful research is imperative in selecting a factoring partner that matches your company's goals and ethos. This is where the support service offered by FundInvoice will help you by finding quotes and helping you compare debt factoring offers. Please call us on 03330 113622 for support.