- 19 Jan

How Important It Is To Compare Factoring Prices

We have updated our mystery shopper research in order to compare factoring prices between different providers.

You can check your pricing against our panel of providers.

Interesting results; there is a huge pricing differential between the top and bottom of the table.

Compare Factoring Prices

Compare Factoring Prices

We found that the range of costs quoted (estimated service charge and discount charge combined, based on a small factoring client) revealed a difference in pricing of 165% between the cheapest price and the most expensive that we were quoted.

This means that the highest pricing was approximately 2.7 times more annually than the lowest price - a huge difference.

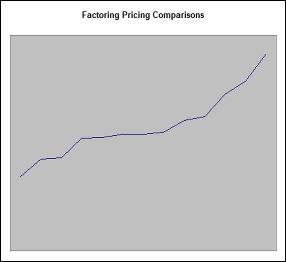

The graph to the left shows each factoring company's combined service charge and discount charge pricing, with the total estimated cost (based on assumptions about the level of borrowing, etc.) on the vertical axis. This visually demonstrates the substantial difference between the lowest and highest quotes.

Need an explanation of how the costs of factoring work?

The line also shows that it is not a case of most quotes being similar, and just one or two being at the extremes. In fact, is shows that there were steady incremental pricing increases between the lowest and the highest quotes.

Comparing Service Charge

Looking at just the service charge, the range was even bigger. There was a 203% difference between the cheapest factoring company and the most expensive.

This only goes to demonstrate how important it is to search for factoring quotes before you commit to a particular provider.

Other Things To Consider

There were a number of other differences that were highlighted by our study:

1) Minimum Fees

In some, but not all cases, there was a minimum service charge quoted. This can be a charge if your business fails to achieve the level of factored turnover anticipated.

2) Minimum Base Rate

In some, but not all cases, there was a minimum base rate quoted. That means that even if the base rate is low, 0.25% at present, you can still be charged a higher rate because of the minimum set in the agreement. This could be several percentage points higher and is charged in addition to the discount margin.

Need Help Finding Quotes?

If you need help finding the best factoring quote for your circumstances, please either contact us or speak to Sean on 03330 113622.

Comments (2 comments)

Jeffrey Burton

"Glenn, An interesting subject. However factoring prices should take into account risk. With over 30 years running non-standard factoring companies I concede we will be at the expensive end of your graph. A typical client will have no net worth and we have to rely on written invoice verification and often have to deal with requests for overpayments because of the weakness of the client and so resulting in a heavy workload justifying the cost."

12:00 - Sunday January 22nd, 2017

Glenn Blackman

"Jeffrey, thank you for your comment. This particular study focused purely on the differences in pricing between factoring companies and I have had a few comments about the other factors that need to be taken into account in making a decision about how to choose between providers e.g. service levels. You are also quite right that the cost often needs to reflect the fact that many clients don't have any other security to offer beyond the integrity of their book debts and so I understand the need to charge for that risk taking."

12:00 - Monday January 23rd, 2017

Add Your Comment