- 04 May

Invoice Finance Optimisation And Future Predictions

Recently, I was contacted by a LinkedIn connection that was seeking a speaker for an upcoming online event. As it happened, my participation had to be marked forward but as I had already prepared the material, I thought it would be worth sharing it.

Below you will find details of my presentation and what I planned to say, let me know if you agree or have anything to add or change.

Invoice Finance Optimisation

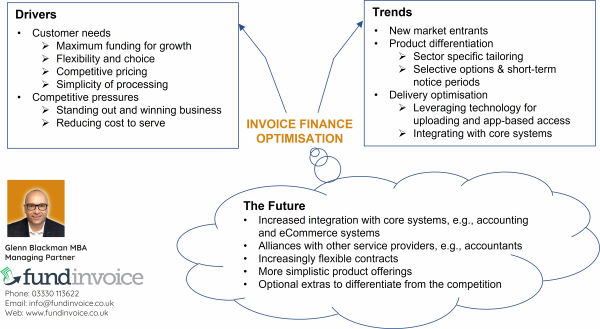

My short piece was to be about invoice finance optimisation. This is how the market has adapted to the drivers affecting it. I also wanted to take a look at future predictions regarding how these products are likely to develop.

For those who don't already know, invoice financing is the provision of prepayments against credit invoices to aid business cash flow. In addition to that funding, there are a variety of add-on services that can be included, e.g., credit control, payroll or bad debt protection.

The Future Of Invoice Finance In the UK

I designed my presentation around a single slide. This addressed the drivers behind how this product set has developed and the trends that we are seeing at present.

The Drivers

I split the drivers into those that are client-side and those that are originating from the providers. Clients seem to be seeking maximum funding, prepayments have risen in recent years to meet this need, especially in prime sectors such as recruitment. Flexibility and choice refers to customer product choices. Increasingly, we have seen customers seeking selective invoice finance arrangements, where they can pick and choose invoices for funding without any obligation to finance them all. Having said that, the majority still seek whole turnover facilities.

From the invoice finance companies, drivers include how to stand out from their competitors and trying to reduce their cost to serve.

Current Trends

These drivers have sparked several changes in the marketplace. There have been a number of new entrants in recent years, increasing the number of UK invoice funders to over 100+. In turn, there has been some product differentiation. Sector-specific products for niches such as construction and recruitment have become available. Increasingly, we have seen selectivity offered to customers and short notice periods or even open contracts where the customer can leave at any time.

Many of the funders have leveraged technology to better meet customer needs and also to drive down their cost to serve. In the past, invoices were submitted in paper form (a schedule of debt). This has developed to include file upload and more recently full integration with a variety of accounting packages. This has enabled full sales ledger upload and automated submission of other accounting information. Some providers are integrating their funding into core systems, e.g., accounting systems. Effectively, this gives the customer a "fund this invoice" option for each transaction.

The Future

I suspect there will be an increasing pursuit of integration with core systems such as accounting packages and eCommerce systems. These give funders the chance to participate in the financing of transactions as they arise, becoming an integral part of the customer's business cycle.

There are already many alliances between funders and other service providers, I would expect this to continue to develop. For example, accountants are integrated into the core practices of businesses. Hence, they are highly sought-after connections for funders.

Competitive pressure from the increasing number of providers is likely to see continued increases in the flexibility of contracts. Shorter contract periods have become the norm and the complexity of product offerings is likely to continue to reduce. Already, there are offerings that are more simplistic than those that were offered in the past, this trend is likely to continue. One of the biggest criticisms is often how complex receivables financing can be.

Packaging of products to serve niches is also likely to continue and develop. Putting together service packages for sectors or groups of businesses that can be defined in other ways is likely to continue to be a good way of attracting customers who are seeking solutions to a variety of business issues, rather than just funding.

Please let me know if you agree, or if you think that there are other points to add about the future of invoice financing.

- Home

- Business Financing

- Invoice Finance

- Invoice Discounting

- Factoring

- Debt Factoring

- Recourse Factoring

- Fund Selected Invoices

- Business Loans

- Construction Sector Funding

- Protect Against Bad Debts

- Exports Collection And Funding

- Import Funding

- Body Shop Funding

- Spot Factoring

- Retail Sector Funding

- Fund Invoices Confidentially

- Help Running Your Payroll

- CHOCs Customer Handles Own Collections

- Collect Invoices Confidentially And Funding

- Outsourcing Your Credit Control

- Asset Finance And Mortgages

- Case Studies

- About Us

- Testimonials

- Find Out More

- News

- Free Magazine

- Blog

Add Your Comment