- 08 Aug

Scale Up Finance And Scaling Up Ideas

Scale-up finance is about putting in place the financing to enable a business to expand and grow. This might be through organic growth, acquisition (sometimes called scaling out) or some step-change that looks to rapidly increase your business's scale.

Scale-Up Finance For Growing Expanding Businesses

Let's start with a definition of scaling up to understand what it entails.

Definition - What Is Scaling Up?

Scaling up a business involves expanding its operations to increase turnover, market reach, and profitability. However, this growth phase comes with its own set of financial challenges.

Understanding and managing these challenges is crucial for ensuring sustainable growth. This article delves into the key financial aspects that UK-based companies should consider when scaling up their operations.

See our Business Growth Hub for more ideas about how to scale up your business and how to scale up a startup.

Understanding Scale-Up Finance

Scaling up finance refers to the strategies and financial mechanisms that businesses employ to support rapid growth. This involves securing adequate funding, managing cash flow, optimising costs, and ensuring compliance with regulatory requirements. As businesses expand, their financial needs become more complex, necessitating a robust financial strategy.

Sources of Funding For Scaling Up

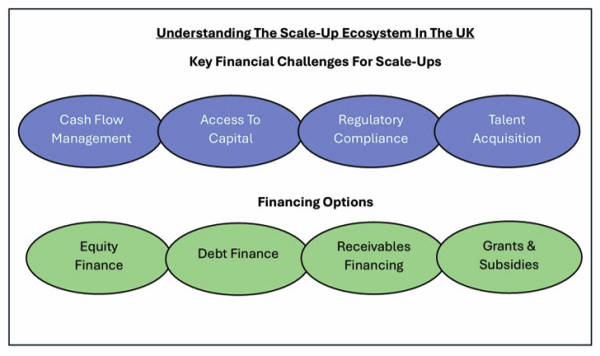

One of the primary concerns for businesses looking to scale up is securing sufficient funding. There are various sources of scale-up financing and funding available to UK companies, each with its own advantages and disadvantages.

See our related article for a comprehensive look at the full range of ways to fund a business.

In essence, the options and ideas for funding such situations are likely to include:

- Equity Financing - which involves raising capital by selling shares of the company. This can be done through private investors, venture capitalists, or by going public with an initial public offering (IPO). The advantage of equity financing is that it doesn’t require repayment. However, it does dilute ownership and may lead to a loss of control over business decisions. Certain types of crowdfunding (online platforms that allow you to raise small amounts from many people) can also operate on this basis.

- Debt Financing - involves borrowing funds that must be repaid with interest. Common forms of debt financing include business loans, bank overdrafts, and lines of credit. While debt financing doesn’t dilute ownership, it can require regular repayments, which can strain cash flow if not managed properly. Crowdfunding can also operate in this way.

- Receivables Financing - this is a way of getting an advance against your invoices before your customers pay. It works well for growing businesses as it increases in line with the volume of invoices that you raise. This is not the case with other forms of finance so it can be ideally suited to scaling up.

- Grants and Subsidies - there are numerous grants and subsidies available to UK businesses from government bodies and other organisations. These funds are typically non-repayable and can provide a significant boost to a company’s financial resources. However, they often come with strict eligibility criteria and application processes.

UK Ecosystem For Scale-Ups Infographic

This infographic summarises the UK ecosystem for scale-ups and their financial challenges:

Case Studies: Scaling Success Across Industries

When exploring scale-up finance options, it's crucial to consider industry-specific challenges and opportunities. For example, a technology startup may benefit from venture capital due to the rapid growth potential and need for significant early investment. On the other hand, a manufacturing business might find asset-based lending more suitable, leveraging equipment or stock and invoices as security for the funding. Highlighting these industry nuances can help businesses choose the right financial strategy tailored to their unique growth trajectory.

See also: Case Study Where We Helped A Company Scale Up

User Testimonial

This is a user testimonial from a business we found the best financing options to help them scale their business to the next level.

"5 stars. The service has been great. Not just for the service they provide but for the way they carry out their business. Not like other companies who chase until they get an answer they present you with options and from an impartial point of view help decide the best options to take your business to the next level." (Client Reference: 10722).

Hybrid Financing Models for Flexible Growth

As businesses scale, they often require more than just one type of financing. Hybrid financing models, which combine elements of different financing methods, offer a flexible solution. These models allow businesses to maintain control while accessing necessary capital. For instance, blended financing options such as receivables finance combined with a business loan and stock finance could offer increased funding levels by leveraging more of the assets of a business. Exploring these options can be vital for companies looking to scale efficiently without diluting ownership.

Alternative Funding Sources for Scale-Ups

While traditional financing options like bank loans and venture capital are well-known, alternative funding sources can provide unique benefits. Receivables-based financing can release additional cash that is from an asset that you already own. This can generate additional liquidity that is vital in scaling situations. This funding also grows with your turnover. Similarly, strategic partnerships or alliances can offer funding along with access to new markets or technologies, providing both capital and growth opportunities. However, be aware of becoming dependent upon other parties and losing control of the management of your business. Exploring these alternatives can open doors to innovative growth strategies that might not be possible through conventional means.

Current Trends in Scale-Up Finance

The financial landscape is rapidly changing so businesses looking to scale up have access to a diverse range of funding options. Fintech has revolutionised the industry by offering innovative solutions like receivables finance, crowdfunding, peer-to-peer lending, and blockchain-based financing, making it easier for businesses to secure capital. Additionally, the global economic environment has influenced traditional lenders to become more flexible, providing tailored financial products that cater to specific business needs. Staying informed about these trends is crucial for businesses aiming to scale effectively and sustainably.

Other Things To Consider When Scaling Up A Business

Scale-Up Planning

You need to produce a robust plan for the scaleup phase. This will include how you are going to go about this expansion and what your scale-up business model will look like. See these Top 10 Tips For Scaling Up.

Managing Cash Flow & Cash Flow Forecasting

Effective cash flow management is crucial for any business, but it becomes even more important during the scale-up phase. Rapid growth can put a strain on cash flow, making it essential to have a clear understanding of incoming and outgoing funds.

Regularly forecasting cash flow helps businesses anticipate periods of surplus and shortfall. This allows for better planning and decision-making, ensuring that the business can meet its obligations and invest in growth opportunities.

Contingency Planning

Having a contingency plan in place for unexpected expenses or sales shortfalls is vital, especially if you are in a period of rapid expansion. This could involve setting aside a reserve fund or having access to finance to cover emergencies.

Navigating Regulatory Challenges During Scaling

As businesses grow, they often encounter new regulatory landscapes that can impact their operations. For example, expanding into international markets introduces complexities such as compliance with different tax laws, employment regulations, and industry-specific standards. Businesses should proactively engage with legal and financial advisors to navigate these challenges, ensuring that their scale-up efforts are not hindered by unforeseen regulatory hurdles.

Preparing for the Ultimate Scale-Up: Exit Strategies

Scaling up often leads to a pivotal moment—whether it’s an acquisition, merger, or company floatation. Proper financial planning for these events is crucial. Businesses should focus on building a strong financial foundation, ensuring that their financial statements, legal documentation, and growth metrics are in order. This preparation not only attracts potential buyers or investors but also maximizes the value at exit, providing a lucrative return on the scale-up efforts.

Scaling Finance FAQs Section

What is scale-up finance?

Scale-up finance refers to funding options designed to help businesses grow rapidly. This could include receivables financing, loans, equity financing, or hybrid models tailored to the specific needs of scaling businesses.

How do I know how much funding I need?

Determine your funding needs by creating a detailed financial and cash flow forecast, which includes projected expenses, turnover, and growth targets. Consulting with financial advisors can also help provide clarity.

What are the risks of taking on scale-up finance?

The risks include over-leverage, loss of control in equity financing, and financial strain if growth projections are not met. It’s important to choose the right type of financing based on your business model and risk tolerance.

How do different industries approach scale-up finance?

Different industries have unique financing needs; for example, tech startups might seek venture capital, while manufacturers might prefer asset-based lending.

- Home

- Business Financing

- Invoice Finance

- Invoice Discounting

- Factoring

- Debt Factoring

- Recourse Factoring

- Fund Selected Invoices

- Business Loans

- Construction Sector Funding

- Protect Against Bad Debts

- Exports Collection And Funding

- Import Funding

- Body Shop Funding

- Spot Factoring

- Retail Sector Funding

- Fund Invoices Confidentially

- Help Running Your Payroll

- CHOCs Customer Handles Own Collections

- Collect Invoices Confidentially And Funding

- Outsourcing Your Credit Control

- Asset Finance And Mortgages

- Case Studies

- About Us

- Testimonials

- Find Out More

- News

- Free Magazine

- Blog