- 04 Jun

Avoiding The Consequences Of Bank Overdraft Restrictions For Start Ups

This is a further analysis of the consequences of bank overdraft restrictions on start up businesses.

My previous article identified a group of 23 start ups within our sample of 100 start ups that had used bank overdraft to fund their new start business and had experienced restrictions.

In all cases they said that the restrictions were because the "bank would not lend enough".

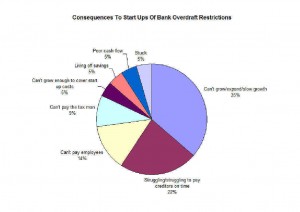

The consequences of those restrictions, as shown in the diagram above were very problematic for new start businesses - remember that in our sample, 44% of those that used overdraft to fund their new start business said they had less funding than they needed. Of those:

- 35% couldn't grow/expand or said that they had experienced slow growth

- 22% were struggling or struggling to pay creditors on time

- 14% were unable to pay their employees

- 9% were unable to pay their taxes

- 5% couldn't grow enough to cover their start up costs

- 5% were living off their savings

- 5% had poor cash flow

- 5% just said they were "stuck"

In contrast to overdraft, the small proportion (just 2% of our sample of start ups) that used invoice finance to fund their start up said they had all the funding they needed and avoided these consequences of restictions in bank overdraft.

- Home

- Business Financing

- Invoice Finance

- Invoice Discounting

- Factoring

- Debt Factoring

- Recourse Factoring

- Fund Selected Invoices

- Business Loans

- Construction Sector Funding

- Protect Against Bad Debts

- Exports Collection And Funding

- Import Funding

- Body Shop Funding

- Spot Factoring

- Retail Sector Funding

- Fund Invoices Confidentially

- Help Running Your Payroll

- CHOCs Customer Handles Own Collections

- Collect Invoices Confidentially And Funding

- Outsourcing Your Credit Control

- Asset Finance And Mortgages

- Case Studies

- About Us

- Testimonials

- Find Out More

- News

- Free Magazine

- Blog