- 21 Nov

Business Finance For Startups And Newcos

Conducting a small piece of research was a good way to find out how easy it is for a new startup to find its way to business finance brokers such as ourselves, who can help with invoice finance products.

I used the situation of a company that is highly suited to using some form of cash flow funding - although they may not know the name of the product that they are looking for. The result was that it was very difficult to see how they would naturally find their way to such services through a simple Google search for a generic term. The search term I used was "business finance".

Finance For New Startups

New startups that are looking for business finance are one of our target market segments. Although often they don't really know the type of product that they are looking for, they just know that they need some additional cash injected into their company for working capital purposes. We have plenty of funders that can help start-ups, even if they don't have a previous trading history, they don't have assets for security, or they have a previously poor credit history.

New startups that are looking for business finance are one of our target market segments. Although often they don't really know the type of product that they are looking for, they just know that they need some additional cash injected into their company for working capital purposes. We have plenty of funders that can help start-ups, even if they don't have a previous trading history, they don't have assets for security, or they have a previously poor credit history.Companies and Newcos in this segment are less likely to qualify for traditional forms of finance, such as start-up loans, so an invoice finance solution is likely to be an easy option, with several providers seeking to help new start-ups. The other benefit is that even if they can find a loan, the volume of funding from receivables financing tends to be much higher. If you need to raise capital, factoring could be a great option for a business without any track record.

Watch our video: Will Banks Lend Money To Startups?

Google Search For "Business Finance"

So I put myself in the place of an entrepreneur looking to start a recruitment business in London, at the point that I have identified that I have a funding requirement - so without being specific I might turn to the internet initially, and try a Google UK search for say "business finance".

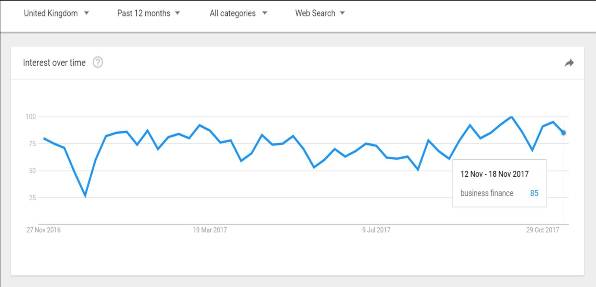

Over the last year, there have been somewhere between 25 and 100 searches a day via Google UK for the phrase "business finance". The chart below shows the volume of searches and how they have moved over that period.

The chart above demonstrates that there are a number of people using this term, but the size of the subset that could be eligible for invoice finance is not apparent. However, it seems reasonable that this might be a generic search term that could be used by a company with funding needs that could be met through the use of factoring or invoice discounting.

Search Terms

The first thing I notice is that as I type "business finance" into the browser (I was using Chrome), Google suggests some search terms to append the phrase "business finance" as follows:

- solutions

- course

- compared

- car

- guide

- brokers

- jobs

- UK

- for dummies

Some of those might be helpful to a company in the situation described, e.g. "solutions", "guide" or "brokers", but some are clearly not really relevant, e.g. "course" or "jobs". Are the more useful terms likely to help me through to my end goal? Perhaps. If I found a good guide or broker they might provide a map of the funding landscape that could point me in the right direction.

In this instance, I continued with the simple search for "business finance" but could have looked for commercial finance solutions.

Search Results

The very top search result in Google is a paid advert by a loan company. The ad clearly states "No startups," so that is not going to help someone in my situation. The fact that they have included that criterion in their paid advert suggests to me that a lot of new start-up companies have contacted them for funding, not realising that they are going to be unable to help until they are established businesses.

Google Paid Advertising

This kind of paid advertising is going to be very expensive. A quick look at the projected costs for this term suggests that I might have to pay £28+ per click in order to appear at the top of Google's search results, and there are no guarantees that people clicking my advert would be potential customers - they could be students or even competitors. The cost of this kind of advertising excludes small companies from appearing in these kinds of paid results.

The next one down in the paid results is another loan option. When I dug around their site (I was careful to avoid incurring any cost for these advertisers), it says they can help startups with up to £25K, but no more unless they have security. If I expect to transact some volume in my first year, that is unlikely to be enough, and the reducing nature of a loan means that I will have to pay it back each month, on a reducing basis. Invoice finance, on the other hand, would provide revolving finance that stays in place without me having to meet any capital repayments.

So I return to the Google search and look at the rest of the paid adverts at the top. There is one provider offering to compare 15 lenders. A number of funders then appear on the page. The top option is a loan broker, so it is probably not likely to find what I need there. The next is that loan company again, then another loan broker requiring 18 months of trading history as a minimum, then a business credit card provider, and then one of the invoice finance houses. However, the particular product being offered is another loan, and a visit to their site confirms that I would need 2 years of trading history. The sad fact is that their invoice finance offering may have suited my situation and can be provided to startups, although I would not have seen that area of their website from my search.

Organic Search Results

So I returned to the Google search page (I am still only on page 1 here), and I selected the top of the organic search results. Remember that these are the options that Google has decided are most relevant to my search term.

The top result is from a bank, and the entry reads, "Finance options for smaller businesses. Explore your finance options with The Business Finance Guide – a journey from start-up to growth . . ." This sounds more promising. I click a button to open the guide, and a question appears about what stage of business we are in. I answer a new startup, not yet trading. It then presents me with an array of possible funding requirements that I am seeking to solve, i.e. initial funding, the launch of the product, organic sales growth, expansion into new markets, expansion internationally, investing in new facilities, refinance, capital restructuring, improve cash position and acquisition plans. Quite a diverse list and one that some people are unlikely to fully understand.

From the list, I select "Improve Cash Position" as that seems most closely allied to the needs of a business that will have a tendency to use receivables finance. The site then displays the following message: "Unfortunately, that option is not normally available to a business that is a startup not yet trading"! Bizarre when there are invoice financiers that will help small startup companies.

So I return to the organic search results, and the next on the list is a Government site, offering "business finance support". Initially, I am presented with a long list of hundreds of options. The top one is titled "Access To Finance Greater Manchester and Lancaster", which is irrelevant to a London-based business. There is a list of selectable options on the left-hand side, so I selected the type of Support "Finance", and that has narrowed it down to 118 options! The business stage "Not Yet Trading" reduces it to 50 options, and entering my industry sector as "Services" (there is not an option to enter "Temporary Recruitment", which is what I intend to offer) reduces the list to 41 options. The top option is titled "AD: Venture - Leeds City Region" - again, completely irrelevant to me. In fact, a quick scan of the list reveals nothing that seems helpful to me. Numerous regional aid entries, grants and special funding niches, such as funding for child care and various other projects with names such as "Innov8+ expertise and advice scheme - Neath Port Talbot". So, this site has not helped. The odd thing is that as a finance broker, I know that there is advice about invoice funding on the Government site; it just didn't come up via the search pattern that I described above.

The next two organic results are for that bank again and the Business Finance Guide, again - duplicates of the result mentioned in detail above, so I skip past those.

The next result reads, "Find a business mentor. Whatever stage your business is at". I would suggest that someone in my situation might discount that option. I think it unlikely that they would be seeking a mentor, but I followed the link to see what it offered. Again, I was asked for the details of my funding requirements. I entered the same details and was presented with a list headed "We've found you 62 finance options". Another overwhelming set of choices. So what's the top option? A venture capital equity investment is not at all what I am looking for as with venture capital I would have to give up some of the share capital and control of my business. I would prefer a finance option where I borrow the money I need, and it is paid back without the funder taking any kind of stake in my company.

Invoice Finance Company

The next option is yet another loan provider, which I discount again, and then finally, the third option is a well-known invoice finance company. Their promotional paragraph talks about "invoice finance", mentions various product names such as "factoring", and talks about "cash flow solutions". So I might have stumbled onto something useful here, although as a business finance broker, I am mindful that 1 in 3 eligible UK businesses told our survey that they were not aware that invoice finance was an option for their business.

Access To The Entire Funding Market

The other issue is that whilst the factoring company's offering may be suitable for me, it is just one of the many options on the market, and if I were seeking this kind of funding, I would want to have access to the entire funding market and to understand where they sit within that market. There are 100+ invoice finance companies in the UK, and there are many differences between offerings, funding levels and pricing. One of our studies showed a 165% differential between the most expensive and the cheapest factoring deal for a particular company.

There are numerous different types of invoice funding on the market: selective facilities (where you can choose which invoices to fund), sector-specific offerings (such as construction finance and packages for recruiters) and various product options such as bad debt protection and export facilities. Service levels also differ dramatically between providers - with average customer ratings in our surveys ranging from 4 out of 10 to 9 out of 10. So, there is a great deal of value in using the services of an experienced industry broker to guide you towards the most suitable service rather than just the cheapest or the easiest to find on the internet.

Difficulties Finding Invoice Finance

So, my quest to find some working capital funding for my London-based, small, new-start recruitment business was not easy. Many people would have given up way back or ended up talking to various loan providers. The point is that it is not easy to access the right kind of guidance about business finance, and this small study highlights that there are particular difficulties finding invoice financing options for startups as part of a generic search for some funding support.

Bias In Search Engine Results

There can be a bias in search engine results. These kinds of search engine results are often skewed towards offerings on Government sites and the websites of large companies that can afford the SEO (search engine optimisation) activity to move up the search rankings. In order to rank well organically for search terms such as the one described above, one would need to seek inward links from Government websites, educational sites, news sites and sites that might be considered competitors. Again, large companies with huge SEO and advertising budgets may be able to pursue this kind of strategy, but it is going to be difficult for small advisory firms to compete - and this is often the best place for a customer to begin. This bias is demonstrated by the process described above, which may have caused some users to just give up and speak to their bank.

Other Routes To Find Invoice Finance

Indeed, another piece of our research found that 51% of invoice finance users found their way to these products via their bank. With a further 15% going via their accountant. In the case of banks, they may again be a great option, but comparisons need to be made with the independent sector to understand what is on offer across the board. We found customer satisfaction ratings to be 45% higher amongst users of independent providers when compared with bank-owned providers.

Those who go via their accountant may also find the range of options to be somewhat limited. Again, our research suggested that, on average, accountants told us that they had links with only 2 different providers - which does not provide access to the full market.

Best Practices When Seeking Funding

These results have shown how hit and miss it can be when a business suited to receivables funding uses the internet to try and navigate the funding landscape. The number of "blind alleys" and irrelevant results show how difficult it is to find your way to the right products. Without having knowledge of the various available products, they are probably going to struggle to route out options such as funding against invoices. Some advice is needed, and working with an independent party would seem to be the most sensible approach. All individual funders will, of course, have their own bias, and our research suggests that accountants are unlikely to have the breadth of contacts required to get access to the full market (it must be noted that some accountants do have their own brokerage arms now and more extensive lists of contacts).

The best practice process through which to find these kinds of services is to use a good quality business finance brokerage service. Going directly to providers exposes the user to the risk of selecting suppliers that are not going to be well suited to their needs or that do not have the best offering that is on the market. It also shuts off access to other offerings that they are unaware of.

It is also good practice to look for testimonials about the broker from customers that they have helped. This will give you some comfort in the service that they provide. It is also prudent to question them about their independence so that you understand what its limitations may be. For example, they may have investments in particular funders, or they may be part-owned by particular providers. In either case, you should seek to understand their position so that you can be assured that you are getting an unbiased opinion of the options for your company.

A good broker will be aware of what is on the market, will be completely independent of any provider and will be prepared to provide free advice to businesses seeking business finance.

- Home

- Business Financing

- Invoice Finance

- Invoice Discounting

- Factoring

- Debt Factoring

- Recourse Factoring

- Fund Selected Invoices

- Business Loans

- Construction Sector Funding

- Protect Against Bad Debts

- Exports Collection And Funding

- Import Funding

- Body Shop Funding

- Spot Factoring

- Retail Sector Funding

- Fund Invoices Confidentially

- Help Running Your Payroll

- CHOCs Customer Handles Own Collections

- Collect Invoices Confidentially And Funding

- Outsourcing Your Credit Control

- Asset Finance And Mortgages

- Case Studies

- About Us

- Testimonials

- Find Out More

- News

- Free Magazine

- Blog