What Is The Cost And Price Of Invoice Finance, Factoring Or Invoice Discounting?

Need an explanation of the costs? Perhaps you want to know what invoice finance will cost. Or what is the invoice finance charge?

Below, we have set out details of how the cost of factoring and invoice discounting is normally structured, together with examples of what those costs may be (see below for product-specific examples).

The only way to know for sure what the cost will be in your particular circumstances is for us to get some quotations for you, but below we provide a general explanation of the costs.

FREE INVOICE FINANCE QUOTE SEARCH

Savings On Invoice Financing Costs

If you contact us, we will search the market for you to find quotes and quotations specific to your business. Call us at 03330 113622.

We will seek to save you money on any existing facility you may have and reduce the cost of invoice financing. We have found substantial average cost savings for our clients on quotations from elsewhere.

We have undertaken extensive research into how costs and fees work. You can read it for free here: Pricing Research.

How Invoice Finance Costs Work

Invoice financing fees depend upon the type of facility that you want.

Factoring Price Versus Invoice Discounting Price

The product type you want will drive the pricing to some extent. Factoring prices—with credit control included (examples below)—will differ from invoice discounting prices—just funding (again, see examples below) as the services delivered by each product vary and the amount of risk taken by the financier also varies. Also, additional services such as bad debt protection or payroll management will normally be charged at a premium.

Most products can thereafter be divided into selective and whole turnover offerings.

Selective Facilities Pricing

Often, customers search for an answer to the question "How much does factoring an invoice cost UK?". Below is a rough cost of factoring an invoice, also called the cost of discounting an invoice.

If you want to select individual invoices to finance, the cost can be very low, and you can do this without being tied into a contract. This is an example of selective invoice finance costing for a larger transaction. However, you can also finance small transactions. Typical fees are between 3% and 5% of invoice values (+ VAT where applicable).

There are variations in the pricing structure between different providers.

Whole Turnover - Funding Against All Invoices

If you want to maximise your funding and finance all your invoices (called whole turnover), the fees work slightly differently. The company that provides your debt factoring or invoice discounting facility will normally make two main charges, which are as follows (but you can have a combined all-inclusive single fee if you prefer).

Single Bundled Fee

The lowest single bundled fee (combining service charge and discount charge) is currently around £3,500 (+ VAT if applicable) per annum.

Unbundled Fees

Below are the unbundled fee options:

Administration Charge (or Service Charge)

This is a fee for managing your debtor sales ledger if you are factoring or for maintaining your account if you are invoice discounting. This is normally expressed as a percentage of the value of the sales invoices that you raise but in some cases, it can be a fixed fee. Typical fees and invoice discounting percentages can be found in the pages below in the section on Typical Fees And Other Charges.

There is a detailed explanation here: How To Calculate Service Charge.

What Is The Discount Charge Or Interest Rate For Invoice Finance?

If you are asking, "What is the interest rate for invoice finance?", interest rate is not the correct term to use for invoice finance facilities. That applies to lending products such as business loans. In the case of invoice finance, there is a charge called the discount charge that is applied.

This is a charge, similar to interest, that is levied in respect of the funds that you use. It will normally be between 2% and 4% over the bank base rate. We are often aware of invoice finance companies that offer special rates in respect of the discount charge, which will save you money. In some cases, there is no discount charge as it can be included within a single fee, often called a "bundled fee".

See a detailed explanation here: How Discount Charge Works.

Typical Fees And Other Charges

You should ask the factoring or invoice discounting company for details of any additional charges that they may make.

Example Costs

For an example of the cost of factoring and invoice discounting, please see these pages that set out examples of factoring prices:

Typical Cost of Factoring Examples*

Factoring costs are normally in three parts:

- Service charge - usually a percentage of turnover or a fixed fee per month.

- Discount charge - charged on the funding you take, which works similarly to interest on a loan.

- Other charges - There may be additional charges, e.g. for CHAPS transfers.

Below are examples of the cost of factoring facilities - the examples are indicative only* (we may even be able to improve on them in some cases).

The examples below are based on you factoring all your invoices for an entire year.

SMALL STARTUP BUSINESS - FACTORING

£100,000 Sales turnover per annum

£14,167 finance released + credit control service

Service Charge - 2.40% of turnover = £2,400 + VAT per annum

Discount Charge - 3.00% over bank base rate = £1,063

Equivalent to - £20.37 + VAT (where applicable) per month, per £1,000 advanced

Equivalent to - 19.9% over bank base rate of: 4.50%

--------------------------------------------

SMALL BUSINESS - FACTORING

£250,000 Sales turnover per annum

£35,417 finance released + credit control service

Service Charge - 2.25% of turnover = £5,625 + VAT per annum

Discount Charge - 3.00% over bank base rate = £2,656

Equivalent to - £19.49 + VAT (where applicable) per month, per £1,000 advanced

Equivalent to - 18.9% over bank base rate of: 4.50%

--------------------------------------------

MEDIUM-SIZED BUSINESS - FACTORING

£1,000,000 Sales turnover per annum

£141,667 finance released + credit control service

Service Charge - 0.75% of turnover = £7,500 + VAT per annum

Discount Charge - 2.50% over bank base rate = £9,917

Equivalent to - £10.25 + VAT (where applicable) per month, per £1,000 advanced

Equivalent to - 7.8% over bank base rate of: 4.50%

--------------------------------------------

LARGE BUSINESS - FACTORING

£3,000,000 Sales turnover per annum

£425,000 finance released + credit control service

Service Charge - 0.40% of turnover = £12,000 + VAT per annum

Discount Charge - 2.50% over bank base rate = £29,750

Equivalent to - £8.19 + VAT (where applicable) per month, per £1,000 advanced

Equivalent to - 5.3% over bank base rate of: 4.50%

--------------------------------------------

*NOTES: The indications above assume the following:

2 months of sales are outstanding

85% funding against the outstanding sales ledger

4.50% bank base rate

Typical numbers of debtors and invoices, ancillary and other charges are not shown or included.

Last updated: 24/02/2025

Typical Cost of Invoice Discounting Examples*

Invoice discounting costs are normally in three parts, although you can also request a single fee structure to make things simple:

- Administration fee (also called admin. charge) - normally a percentage of turnover or a fixed fee per month.

- Discount charge - charged on the funding you take, which works similarly to interest on a loan.

- Other charges - There may be additional charges, e.g. for CHAPS transfers.

These are examples of the cost of invoice discounting facilities - the examples are indicative only* (we may be able to improve on them in some cases).

You should note that the example costings below are only examples to give you an idea of the likely level of charges. There are always offers and discounts available from providers that are seeking to acquire your business. We may well be able to improve on the figures shown in the pricing examples below.

Assuming you want to finance all your invoices for an entire year, the following are examples of the likely costs.

SMALL STARTUP BUSINESS - INVOICE DISCOUNTING

£100,000 Sales turnover per annum

£14,167 finance released

Admin. Fee - 2.10% of turnover = £2,100 + VAT per annum

Discount Charge - 3.00% over bank base rate = £1,063

Equivalent to - £18.60 + VAT (where applicable) per month, per £1,000 advanced

Equivalent to - 17.8% over bank base rate of: 4.50%

--------------------------------------------

SMALL BUSINESS - INVOICE DISCOUNTING

£250,000 Sales turnover per annum

£35,417 finance released

Admin. Fee - 1.85% of turnover = £4,625 + VAT per annum

Discount Charge - 3.00% over bank base rate = £2,656

Equivalent to - £17.13 + VAT (where applicable) per month, per £1,000 advanced

Equivalent to - 16.1% over bank base rate of: 4.50%

--------------------------------------------

MEDIUM-SIZED BUSINESS - INVOICE DISCOUNTING

£1,000,000 Sales turnover per annum

£141,667 finance released

Admin. Fee - 0.60% of turnover = £6,000 + VAT per annum

Discount Charge - 2.50% over bank base rate = £9,917

Equivalent to - £9.36 + VAT (where applicable) per month, per £1,000 advanced

Equivalent to - 6.7% over bank base rate of: 4.50%

--------------------------------------------

LARGE BUSINESS - INVOICE DISCOUNTING

£3,000,000 Sales turnover per annum

£425,000 finance released

Admin. Fee - 0.40% of turnover = £12,000 + VAT per annum

Discount Charge - 2.50% over bank base rate = £29,750

Equivalent to - £8.19 + VAT (where applicable) per month, per £1,000 advanced

Equivalent to - 5.3% over bank base rate of: 4.50%

--------------------------------------------

*NOTES: The indications above assume the following:

2 months of sales are outstanding

85% funding against the outstanding sales ledger

4.50% bank base rate

Typical numbers of debtors and invoices, ancillary and other charges are not shown or included.

Last updated: 24/02/2025

CHECK INVOICE DISCOUNTING PRICES

Additional Fees And Charges

We have also written an article that sets out in detail how invoice finance price works and all the additional fees that can be part of the tariff of charges. Not all funders charge the same additional fees, so it is worth carefully choosing your provider, as additional fees can add up.

Credit Protection Element

If you opt for non-recourse (with bad debt protection), this will involve an additional premium normally added to the service charge or administration charge percentage. Typically, this starts at 0.45% of invoice value (+ VAT where applicable).

How Rates Compare Between Providers

You will find that the rates differ when you compare providers.

You will find that the rates differ when you compare providers.

You can use our Invoice Finance Price Comparison Spreadsheet to compare quotes received from different providers.

Pricing Research

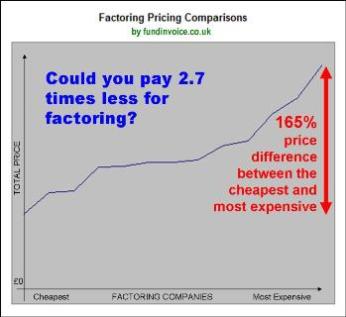

We conducted some factoring pricing research whereby we spoke to a range of different providers and asked them all to quote for the same client, i.e. with the same variables quoted to each provider. It was an average client, with nothing exceptional about its statistics or trade, therefore, you may have been forgiven for expecting all the fees to have been similar.

However, in our study, none of the prices we received were the same, and the range exhibited a 165% overall cost difference between the cheapest and the most expensive providers. Note that we used consistent projected statistics to estimate the annual cost of each facility for comparison.

The graph in the image demonstrates visually both the disparity between different offers and the range of prices that were quoted; each point on the line was another fee structure that we received.

Comparing just the service charge element, the difference between the top and bottom of the table of prices was 203%, a huge difference.

The Issue With Randomly Picking Providers

If you were to randomly pick just one provider at the bottom of the table with no knowledge of how they compared to other providers, you could end up paying 2.7 times more than if you happened to pick the cheapest provider.

This only reinforces how important it is to shop around or get some advice before you decide to go with any particular provider. You should also be aware that there are always offers and discounts being offered by certain factoring companies, so you might want to take these into account.

How To Get An Invoice Financing Quote Comparison

The exact charges are particular to your circumstances, so we would need to gather some basic details from you to find and compare specific quotations for your business. If you would like us to search the market for quotations for factoring or invoice discounting and make a comparison for your business, please get in touch with us, and we will do the rest:

REQUEST AN INVOICE FINANCE QUOTE SEARCH or call Sean on 03330 113622 and he will do all the searching around for you.